Pandemic, war, retrenchments…I get it. It’s super difficult to manage your finances like a grown up with the world changing all the time.

But it isn’t impossible. Simply repeat the following exercise as many times as your life circumstances change.

How often have you thought if I could just earn more money, I would…

Don’t even finish that sentence!

I’ve been there. But if you have dreams that you want to come true, it’s time to manage your finances like a fucking grown-up. Irrespective of what age you are. And what state your finances are in.

I’m not saying these 5 tips are going to make you super wealthy but they will A) make you conscious around money and B) you may find that the dreams you have are possible with a few small changes.

What’s the problem in your finances?

Do you feel like you can never take a holiday?

Or that you can never buy just the small luxuries you so desire?

Or even just that you can never make it to the end of the month?

It’s time to manage your money like a fucking grown up.

I don’t mean that you haven’t been or that you should be ashamed of where your finances are. We all have stuff going on and all need help.

And that’s exactly what I want to do.

Who are you to teach me about finances Lisa?

I’m no one. I’m literally a no-one but I have been in debt before and I have been in hard times when I haven’t been able to afford a cup of coffee.

And I wrote a book called “Stop the Debt Bus” (which I’m currently re-editing for release in 2024) because I wanted to share some of what I learned about getting out of debt.

On that note, I’m not a financial advisor and also I don’t have kids so I can’t relate to having to devote a massive chunk of earnings to school fees and the needs of a family.

On that basis, you may choose to read further or not.

What are the areas of finances to consider in your personal budget?

What are the most important aspects to your personal budget? Whilst not all may apply to you, these include;

- Living costs

- Home

- Savings

- Health and medical

- Dreams

- Retirement

- Investment

Living costs

Okay you’ve got to live, first and foremost. This means you need food and in all likelyhood trasport and your mobile phone as the key essentials here. Add to this your luxury spending like gym, daily coffee and haircuts. These are what’s known as your your living costs.

Home and housing

I’ve put this as separate to home and housing because this could be a cost or investment depending on your circumstances.

Savings

Hopefully you’ve got savings on the list because of rainy days and all that jazz. Don’t panic if you don’t. You can always start.

Health and Medical

Then you may need to pay for medical costs or healthcare depending on where you live and what benefits you receive.

Dreams

Dreams are VERY VERY important because they are what keep the human spirit alive. If you don’t have dreams and aren’t investing in them, then it could be time to do something about it. Of course, if you’re happy like that then that’s fine.

Retirement

At some point in your life, you’re going to want to stop working and then you’re going to need a source of income.

Investments

This is a potential optional on your list in a personal budget. Investments can come in the form of shares or traditional financial investments or even investing in a business or in a new skill. In this way studying can be an investment.

Whilst you may not have a personal budget, you’ve probably allocated spending to some of these areas, if not all.

5 tips to manage your finances like a grown up

1. Do your finances by design

Our financial lives just like our real ones rarely go according to plan but without a plan you are doomed to failure.

What if, in the year to come, you planned your finances by design?

That means just 3 things;

- Set your financial goals for the year (3 max)

- Set your life goals for the year (3 max)

- Put away or invest up to 25% of your current earnings for the future

- Set a personal budget (and try more or less to keep to it)

I 100% agree this is MUCH easier to do as a salaried employee than it is as a business owner. But again it’s better to plan and adjust the plan according to the circumstances than to just leave everything to chance.

When setting your goals, keep to the SMART principle of being specific, measurable, accurate, realistic and timely.

If driving a Ferrari is your dream, maybe you’ll have to settle for a luxury car driving experience day. Get what I mean?

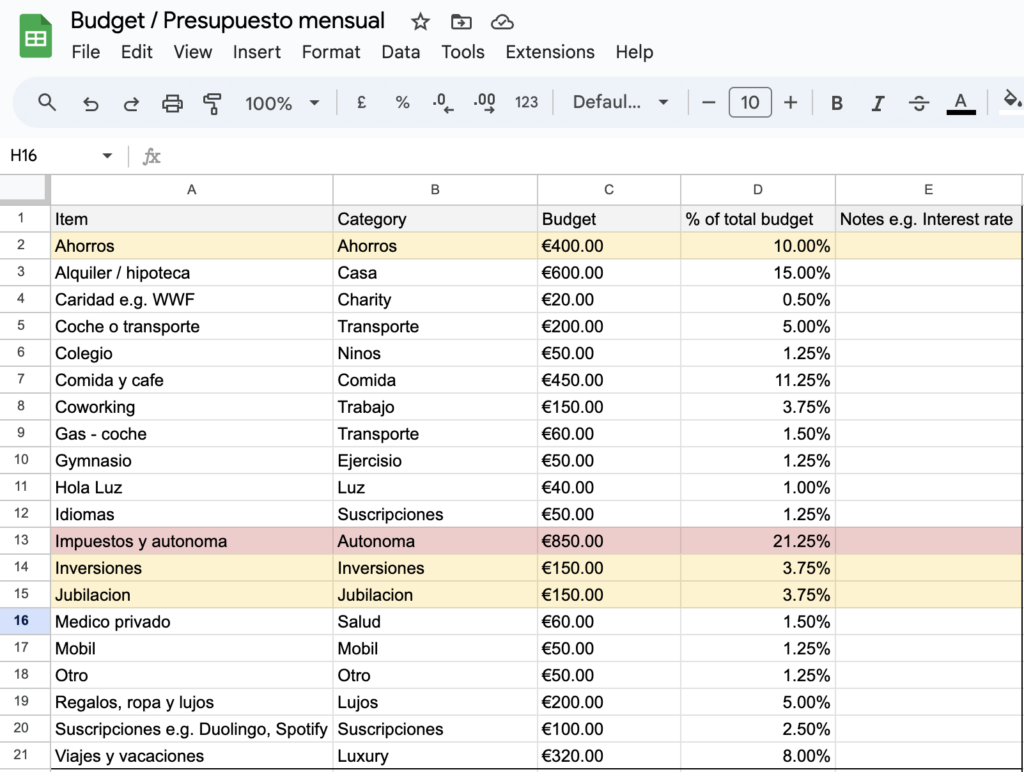

As for your personal budget, think about all of the items that relate to your personal spending in the top 7 categories. Literally, draw it up.

You can download the sample spreadsheet below in English or Spanish.

Why do your finances by design?

Your finances should mirror your life priorities. If they don’t, something needs to change.

2. Set up your accounts to succeed

You know how if you workout with a friend or a trainer it’s much easier to get up for a workout? Well that’s called setting yourself up to succeed.

It’s the same with finances. The more you systemize (that simply means to set up a system), the more likely you are to succeed.

Banks like N26 in Europe, x in the US, X in Australia and X in South Africa give you the option of creating designated spaces. So you can set up your accounts to reflect the important areas in your life.

OR they give you the option to have different accounts within one account. So you know exactly what money you have where.

The main things are to make sure you have accounts or spaces for;

- Taxes

- Daily living costs including housing

- Savings

- Retirement

Bottom line? Your accounts should mirror your life and make it really easy to see what’s happening.

If it’s all in one account together, it’s a mess.

3. Bypass yourself with automated payments

Human nature is to spend before saving. If you see a figure in your bank account, you’re more likely to spend it. Don’t blame yourself – you’re human.

So you’ve got to bypass yourself. And now it’s easier than ever to do that!

Remember that sage old advice, pay yourself first.

Well, you’ve got to do that.

On the day you get paid, or if you’re an entrepreneur choose a certain date of the month, automate payments out.

- Pay a set sum into your savings

- As an entrepreneur, pay your taxable income into a separate account

- Set up a debit order – even a small monthly amount into a returement account

- Pay into your dreams account

- Pay your landlord or mortage

- Set up a debit order for things like your mobile phone

- If you’re worried about spending all your food money, draw the amount in cash and give yourself a weekly allowance.

NOW you can spend on the other things without feeling guilty because all the important stuff is taken care of.

4. Don’t leave money on the table

We are all leaving money on the table in the form of bank fees, tax and interest if not other things.

Bank fees;

I used to pay 30 Euros (that’s R600 in South Africa or $25) in bank fees. This was so I could have access to a private banker and could access the lounge at the airport when I travelled.

Although I travel relatively often to be honest, just to get free food in the lounge, doesn’t really mean anything to me.

Interest;

No matter where you live, you pay more interest on what’s owed than on your savings. But that doesn’t mean you should just ignore interest completely. Compound interest is the 8th wonder of the world for a reason.

Make sure for your savings accounts, (this goes without saying for investments) that you’re earning some form of interest in your savings.

Tax;

If I had to choose just 1 person to keep in my life, I’d have to say it would be my tax consultant. Okay that’s a joke but seriously she’s that good!

This may not be relevant in the case of being a paid employee but in the case of being a freelance or entrepreneur, you’re probably leaving money on the table.

Even if you pay a consultant to do your tax, it’s likely to be worth it financially in terms of what you get back.

EVERY little bit helps! Don’t leave money on the table. I’m sure at the end of a year, you’d rather spend what could be as much as between 1% and 5% of what you earn on something you REALLY want, rather than giving it away.

5. Make dreams possible

How many times have you said you don’t have money for travel? Or for an item you really want. But then you buy two coffees a day and eat out a few times a week and often splurge on a non-essential?

Plenty! Me too!

Until I decided to implement the above steps.

I used to spend on the most ridiculous things until I actually sat down and thought about what I wanted and how to make it happen.

Did I buy my dream Ducati motorbike? No but I did buy a gorgeous 2nd hand Kawasaki which I love. I also got to travel to Italy which is a dream I’d had for over 5 years.

Dreams do come true if we allow ourselves to dream and take the steps to make them possible.

The bottom line in managing your finances

Am I where I want to be financially? No but I’m really happy. And that’s a massive part of getting your finances more or less on track.

It’s tricky because…

You have to live like you could live forever and at the same time that you could die tomorrow.

Part of being alive is really enjoying life and doing things that make you happy. And the other part is ensuring that in the future you continue to enjoy life.

So ultimately you want to stop worrying about money, start managing it, and live!

And you can’t sacrifice one for the other. You can’t live all for today by spending everything you have and you can’t not live because you’re worried about tomorrow.

I’d love to hear if this helped you. Drop me a line and let me know how it’s going.

Lisa